GST Registration Process: Complete Step-by-Step Guide 2025

Starting a business in India? Understanding the GST registration process is crucial for your business compliance and growth. Whether you’re a startup entrepreneur in Jaipur or an established business expanding operations, this comprehensive guide will walk you through every step of the GST registration process.

At Tax2Filing, we’ve helped hundreds of businesses in Jaipur complete their GST registration seamlessly. In this detailed guide, you’ll learn everything about the GST registration process, required documents, timelines, and expert tips to avoid common mistakes.

What is GST Registration and Why is it Important?

The GST registration process is a mandatory legal requirement for businesses whose annual turnover exceeds specific thresholds. GST (Goods and Services Tax) registration provides your business with a unique 15-digit GSTIN (Goods and Services Tax Identification Number), enabling you to:

- Collect GST from customers legally

- Claim input tax credit on purchases

- Expand business operations across India

- Build credibility with suppliers and customers

- Participate in government tenders

Who Must Complete the GST Registration Process?

The GST registration process is mandatory for:

- Businesses with annual turnover above ₹40 lakh (goods)

- Service providers with turnover above ₹20 lakh

- Inter-state suppliers regardless of turnover

- E-commerce operators and marketplace sellers

- Casual taxable persons and non-resident taxpayers

Special note: In northeastern states, the GST registration process threshold is ₹20 lakh for goods and ₹10 lakh for services.

GST Registration Process: Step-by-Step Guide

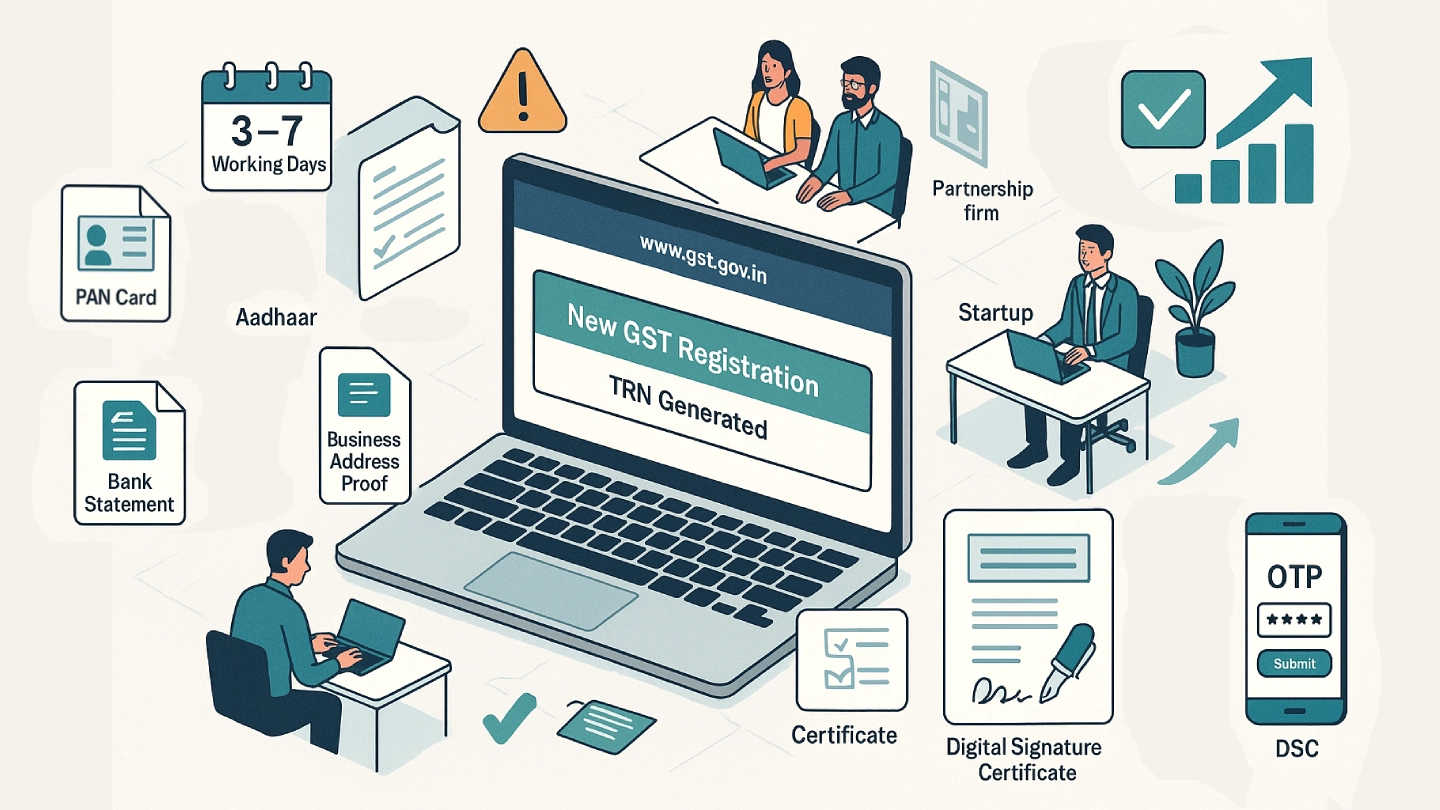

Step 1: Gather Required Documents for GST Registration Process

Before starting the GST registration process, ensure you have these essential documents:

For Proprietorship:

- PAN card of proprietor

- Aadhaar card of proprietor

- Bank account statement or cancelled cheque

- Business address proof

- Passport-size photograph

For Partnership/LLP:

- Partnership deed or LLP agreement

- PAN cards of all partners

- Address proof of business premises

- Bank account details

- Authorization letter

For Private/Public Limited Companies:

- Certificate of Incorporation

- Memorandum and Articles of Association

- PAN cards of directors

- Address proof of registered office

- Bank account proof

Step 2: Access the GST Registration Portal

The GST registration process begins at the official GST portal (www.gst.gov.in). Here’s how to start:

- Visit the GST portal homepage

- Click on “Services” > “Registration” > “New Registration”

- Select your state/union territory

- Choose “Business” as taxpayer type

- Enter your legal name as per PAN

- Provide your PAN number

- Enter mobile number and email address

- Complete the captcha verification

Step 3: Complete Part A of GST Registration Process

Part A of the GST registration process involves basic details verification:

- Legal name verification: Ensure it matches your PAN database

- Mobile and email OTP verification: You’ll receive separate OTPs

- State selection: Choose your state of business operation

- District selection: Select the appropriate district

Once Part A is submitted successfully, you’ll receive a Temporary Reference Number (TRN) for tracking your GST registration process.

Step 4: Fill Part B – Detailed Business Information

Part B is the most crucial phase of the GST registration process, including:

Business Details:

- Constitution of business (proprietorship, partnership, company)

- Business activities and HSN/SAC codes

- Commencement date of business

- Liability to register under GST

Promoter/Partner Details:

- Personal information of promoters/partners/directors

- Residential addresses and contact details

- DIN (Director Identification Number) for companies

Business Address Details:

- Principal place of business address

- Additional place of business (if any)

- Proof of business address

Bank Account Information:

- Primary bank account details

- Account number and IFSC code

- Bank account proof (statement or cancelled cheque)

Step 5: Upload Supporting Documents

The GST registration process requires uploading specific documents in PDF format (maximum 1MB each):

- Identity proof: PAN card, Aadhaar card

- Address proof: Electricity bill, rent agreement, property documents

- Business proof: Shop establishment license, incorporation certificate

- Bank proof: Bank statement or cancelled cheque

- Authorization: Board resolution (for companies), partnership deed

Step 6: Digital Signature and Verification

Complete the GST registration process by:

- Digital signature: Sign the application using DSC or Aadhaar OTP

- Declaration: Confirm all information provided is accurate

- Submit application: Final submission generates Application Reference Number (ARN)

Step 7: Application Processing and Approval

After submission, the GST registration process enters the verification phase:

- Initial scrutiny: GST officer reviews your application (2-6 working days)

- Clarification (if needed): Officer may seek additional documents

- Physical verification: May be conducted for certain businesses

- Approval/Rejection: Final decision communicated via email/SMS

GST Registration Process Timeline and Fees

Processing Time

The GST registration process typically takes:

- Normal cases: 3-7 working days

- With clarifications: 15-20 working days

- Complex cases: Up to 30 working days

Registration Fees

Good news! The GST registration process is completely free. The government doesn’t charge any fees for GST registration. However, you may incur costs for:

- Digital Signature Certificate (₹800-₹2,000)

- Professional consultation fees

- Document preparation charges

Common Mistakes to Avoid in GST Registration Process

Based on our experience helping businesses in Jaipur, here are common GST registration process mistakes:

- Incorrect business information: Double-check all details before submission

- Poor document quality: Ensure clear, readable document uploads

- Mismatched information: Align all details with supporting documents

- Incomplete bank details: Provide accurate account information

- Wrong HSN/SAC codes: Select appropriate business activity codes

Post-Registration Compliance in GST Registration Process

Once your GST registration process is complete, remember these ongoing obligations:

Monthly Compliances

- GSTR-1: Sales return filing

- GSTR-3B: Summary return with tax payment

- GSTR-2A: Auto-populated purchase return

Annual Compliances

- GSTR-9: Annual return filing

- GSTR-9C: Audit report (for eligible businesses)

Expert Tips for Smooth GST Registration Process

From our experience in Jaipur, here are professional tips for the GST registration process:

Before Starting

- Prepare all documents in advance

- Verify PAN details with Income Tax database

- Ensure active mobile number and email address

- Check internet connectivity before starting

During Application

- Save progress regularly to avoid data loss

- Double-check all entries for accuracy

- Upload high-quality documents in correct format

- Keep reference numbers safe for tracking

After Submission

- Monitor application status regularly

- Respond promptly to officer queries

- Maintain document copies for future reference

- Plan for compliance requirements

Why Choose Tax2Filing for Your GST Registration Process?

At Tax2Filing in Jaipur, we specialize in making the GST registration process hassle-free:

✅ Expert guidance through every step

✅ Document preparation assistance

✅ Online application management

✅ Quick processing with 99% success rate

✅ Post-registration compliance support

✅ Affordable pricing with transparent fees

Our GST Registration Process Services Include:

- Pre-registration consultation

- Document verification and preparation

- Online application filing

- Follow-up with GST officers

- Registration certificate delivery

- Ongoing compliance guidance

Frequently Asked Questions About GST Registration Process

Q1: How long does the GST registration process take?

The GST registration process typically takes 3-7 working days for straightforward applications. Complex cases or those requiring additional documents may take up to 30 working days.

Q2: Can I start a business before completing the GST registration process?

You can start business operations, but you cannot collect GST from customers or claim input tax credit until your GST registration process is complete.

Q3: What happens if the GST registration process is rejected?

If rejected, you’ll receive specific reasons via email. You can address the concerns and resubmit your GST registration process application with corrections.

Q4: Is the GST registration process mandatory for online businesses?

Yes, online businesses must complete the GST registration process regardless of turnover if they sell through e-commerce platforms or across states.

Q5: Can I modify details after the GST registration process is completed?

Yes, you can modify certain details through the amendment process on the GST portal, though some changes require officer approval.

Conclusion: Simplify Your GST Registration Process

The GST registration process doesn’t have to be complicated. With proper preparation, accurate documentation, and expert guidance, you can complete your registration smoothly and focus on growing your business.

Ready to start your GST registration process? Contact Tax2Filing in Jaipur today for professional assistance. Our experienced CA team ensures your GST registration process is completed efficiently, accurately, and on time.

📞 Expert Consultation: +91-8505005237

🏢 Visit Our Office: Tax2Filing, C-Scheme, Jaipur

📧 Email: info@tax2filing.com

⚡ Comprehensive Support: Complete CA services for all business needs