Startup Registration in India 2025: Complete Guide & Step-by-Step Process

Launching your innovative business idea? Startup registration provides official recognition, government benefits, and access to funding opportunities that accelerate entrepreneurial success. Whether you’re developing a tech solution in Jaipur, creating a social impact venture, or building a scalable business model, proper startup registration unlocks numerous advantages and positions your venture for sustainable growth.

At Tax2Filing, we’ve successfully completed startup registration for over 150 innovative ventures across Jaipur and Rajasthan, helping entrepreneurs access government benefits, funding opportunities, and regulatory advantages. This comprehensive guide covers everything about startup registration in India, including eligibility criteria, DPIIT recognition process, benefits, compliance requirements, and strategic advantages for entrepreneurial ventures.

Understanding Startup Registration in India

Startup registration is the process of officially registering your innovative business venture with the Department for Promotion of Industry and Internal Trade (DPIIT) under the Startup India initiative. This registration provides formal recognition as a startup entity, enabling access to various government benefits, tax exemptions, funding opportunities, and regulatory advantages designed to foster entrepreneurship and innovation.

What is Startup Registration and the Startup India Initiative?

The Startup India initiative, launched by the Government of India, aims to build a robust startup ecosystem and provide comprehensive support to entrepreneurial ventures. Startup registration under this initiative offers:

Official Recognition:

- Government certification as a recognized startup entity

- DPIIT registration number and official documentation

- Startup certificate for credibility and validation

- Database inclusion in the national startup registry

- Official status for accessing government schemes

- Legal recognition for various business purposes

Policy Support:

- Simplified regulatory procedures and compliance

- Fast-track processing for various approvals

- Single-window clearance for multiple permissions

- Reduced compliance burden and documentation

- Startup-friendly policies and regulatory framework

- Government advocacy and ecosystem support

Financial Benefits:

- Tax exemptions and income tax benefits

- Angel tax exemption and investor protection

- Capital gains exemption for startup investments

- Patent registration cost reduction and benefits

- Government funding access and scheme participation

- Subsidy eligibility for various programs

Who Can Apply for Startup Registration?

Startup registration is available for entities meeting specific criteria:

Entity Requirements:

- Private Limited Company incorporated under Companies Act

- Partnership Firm registered under Partnership Act

- Limited Liability Partnership (LLP) under LLP Act

- Sole proprietorship in certain circumstances

- Section 8 Company for social impact ventures

Eligibility Criteria:

- Incorporation period: Not more than 10 years from date of incorporation

- Annual turnover: Should not exceed ₹100 crore in any financial year

- Innovation focus: Working towards innovation, development, or improvement of products/processes/services

- Scalability potential: Business model with potential for employment generation or wealth creation

- Original entity: Not formed by splitting or reconstruction of existing business

Innovation Requirements:

- Technology-driven innovation and solutions

- Process innovation and efficiency improvements

- Product development and market solutions

- Service innovation and delivery models

- Social impact and sustainable solutions

- Intellectual property creation and development

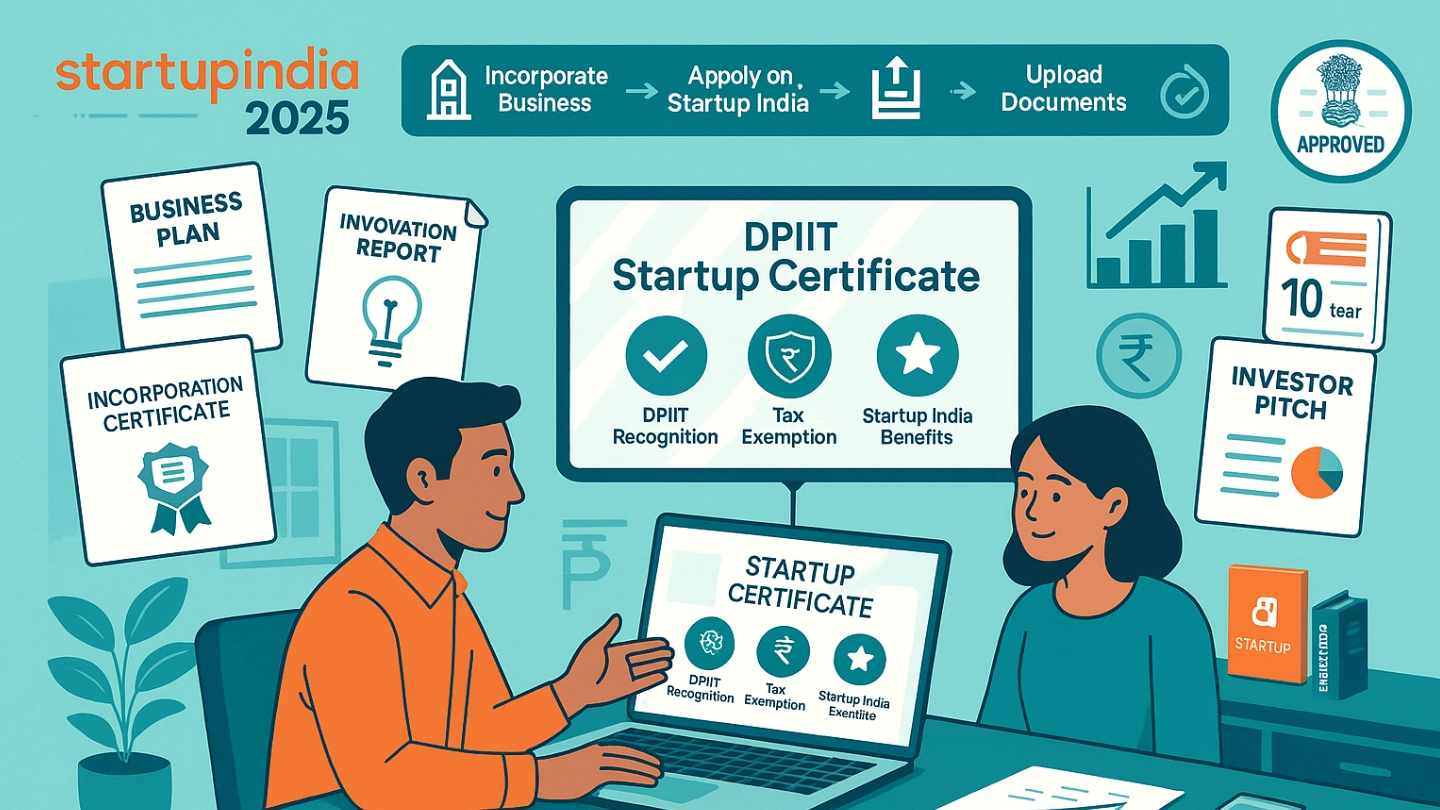

Complete Startup Registration Process

Step 1: Business Entity Formation

Before startup registration, establish your business entity:

Entity Selection: Choose appropriate business structure for startup registration:

- Private Limited Company: Most preferred for startup registration

- LLP: Suitable for professional services and partnerships

- Partnership Firm: Traditional partnership structure

- OPC: Single founder ventures with growth potential

Incorporation Process:

- Name reservation and availability verification

- Director/Partner identification and documentation

- MOA/AOA preparation and customization

- Registration completion with appropriate authorities

- Certificate collection and entity activation

- Post-incorporation compliance and setup

Step 2: DPIIT Startup Registration Application

Complete startup registration through official portal:

Portal Access:

- Visit Startup India portal: www.startupindia.gov.in

- Create user account with valid credentials

- Select startup registration option

- Choose entity type and registration category

- Begin application process and documentation

Application Components:

- Basic information about startup and founders

- Business details and innovation description

- Financial projections and business model

- Funding requirements and investment plans

- Employment generation potential and impact

- Supporting documents and verification materials

Step 3: Documentation and Information Requirements

Essential requirements for startup registration:

Business Documentation:

- Certificate of incorporation or registration

- PAN card of the entity

- Bank account details and documentation

- Authorized signatory identification and proof

- Business address proof and documentation

Innovation Documentation:

- Business plan with innovation focus

- Product/service description and uniqueness

- Market analysis and competitive advantage

- Technology description and innovation aspect

- Intellectual property details (if any)

- Prototype or proof of concept (if available)

Founder Information:

- Identity proof of all founders/directors

- Educational qualifications and experience

- Previous business experience and background

- Contact details and communication information

- Equity shareholding and ownership structure

Financial Information:

- Funding raised or investment received

- Revenue projections and business model

- Employment generation plans and projections

- Investment requirements and funding needs

- Financial statements (if available)

- Banker references and financial credibility

Step 4: Verification and Approval Process

Startup registration involves thorough evaluation:

Application Review:

- Eligibility verification against criteria

- Innovation assessment and uniqueness evaluation

- Business model analysis and scalability review

- Documentation completeness and accuracy check

- Compliance verification with guidelines

Evaluation Process:

- Initial screening by DPIIT officials

- Expert committee review and assessment

- Additional information requests (if needed)

- Clarification rounds and documentation

- Final evaluation and decision making

Approval Timeline:

- Application submission: Immediate acknowledgment

- Initial review: 7-15 working days

- Expert evaluation: 15-30 working days

- Approval communication: 2-5 working days

- Certificate generation: 1-3 working days

Benefits of Startup Registration

Government Benefits and Incentives

Tax Benefits: Startup registration provides significant tax advantages:

- Income tax exemption for 3 consecutive years

- Angel tax exemption for startup investments

- Capital gains exemption under Section 54EE

- Patent filing cost reduction up to 80%

- No minimum alternate tax for first 3 years

- Carry forward of losses against future profits

Regulatory Benefits:

- Self-certification for labor and environment laws

- Fast-track patent examination and processing

- Trademark registration fee reduction

- Simplified procedures for various approvals

- Single-window clearance for multiple permissions

- Reduced compliance burden and documentation

Funding Support:

- Fund of Funds access for startup funding

- Government grants and scheme participation

- Venture capital facilitation and connections

- Angel investor network access and introductions

- Credit guarantee schemes and financial support

- Export promotion and international market access

Business and Commercial Advantages

Market Access: Startup registration facilitates business growth through:

- Government tender participation opportunities

- Corporate partnership facilitation and networking

- Market validation and credibility enhancement

- Customer acquisition support and programs

- Export facilitation and international expansion

- Technology commercialization support and guidance

Networking and Ecosystem:

- Startup ecosystem access and participation

- Incubator connection and acceleration programs

- Mentor network access and guidance

- Investor meetups and funding opportunities

- Industry connections and partnership facilitation

- Knowledge sharing and learning opportunities

Professional Recognition:

- Media coverage and publicity opportunities

- Award eligibility and recognition programs

- Speaking opportunities and thought leadership

- Industry events and conference participation

- Professional networks and community access

- Brand building and market positioning

Industry-Specific Startup Registration Considerations

Technology Startup Registration

Tech Sector Benefits: Technology startup registration offers specialized advantages:

- Software export benefits and incentives

- R&D tax benefits and deductions

- Patent protection and IP registration support

- Technology incubation and acceleration programs

- International expansion support and facilitation

- Talent acquisition and retention programs

Key Focus Areas:

- Product development and technology innovation

- Intellectual property creation and protection

- Market validation and customer acquisition

- Scaling strategies and business model optimization

- Investment attraction and funding facilitation

- Global expansion and market entry

Social Impact Startup Registration

Social Venture Benefits: Social impact startup registration provides:

- CSR funding access and corporate partnerships

- Government grants for social impact projects

- Impact measurement tools and frameworks

- Sustainable development goal alignment

- Community engagement support and facilitation

- Media attention and social recognition

Impact Areas:

- Healthcare innovation and accessible solutions

- Education technology and learning platforms

- Environmental sustainability and green solutions

- Rural development and agricultural innovation

- Financial inclusion and fintech solutions

- Social welfare and community development

Manufacturing Startup Registration

Manufacturing Benefits: Manufacturing startup registration offers:

- Make in India benefits and incentives

- Manufacturing subsidy access and support

- Technology upgradation funding and assistance

- Export promotion and international market access

- Quality certification support and guidance

- Supply chain facilitation and partnerships

Key Advantages:

- Production setup guidance and support

- Quality standards compliance and certification

- Market linkage and customer acquisition

- Technology transfer and collaboration opportunities

- Investment facilitation and funding support

- Export development and international expansion

Startup Registration Compliance and Obligations

Ongoing Compliance Requirements

Annual Reporting: After startup registration, maintain compliance through:

- Annual compliance report submission

- Financial statement filing and documentation

- Employment data reporting and updates

- Innovation progress reporting and milestones

- Funding utilization reports and documentation

- Impact assessment and outcome measurement

Regulatory Compliance:

- Corporate governance and board management

- Labor law compliance and employee welfare

- Environmental clearance and sustainability reporting

- Tax compliance and return filing

- Intellectual property protection and renewal

- Industry-specific regulatory requirements

Renewal and Continuation

Registration Validity:

- 10-year validity from date of incorporation

- Annual confirmation of startup status

- Benefit continuation based on eligibility

- Renewal procedures and documentation

- Status maintenance and compliance requirements

- Exit procedures and benefit cessation

Growth Transition:

- Scaling beyond startup criteria

- Benefit graduation and transition planning

- Continued engagement with ecosystem

- Mentor role for new startups

- Success story sharing and ecosystem contribution

- Alumni network participation and support

Common Challenges in Startup Registration

Documentation and Process Issues

Frequent Problems:

- Innovation documentation and proof requirements

- Business model articulation and presentation

- Financial projections and realistic planning

- Eligibility confusion and criteria interpretation

- Document preparation and quality standards

- Timeline management and deadline adherence

Professional Solutions: Expert startup registration services address these through:

- Innovation articulation and business plan development

- Documentation preparation and quality assurance

- Financial modeling and projection development

- Eligibility assessment and criteria compliance

- Application preparation and submission management

- Follow-up support and status tracking

Post-Registration Challenges

Common Issues:

- Benefit utilization and claim procedures

- Compliance management and reporting requirements

- Funding access and investor connections

- Market validation and customer acquisition

- Scaling challenges and growth management

- Ecosystem navigation and networking

Expert Support: Professional services provide:

- Benefit optimization and claim assistance

- Compliance calendar and deadline management

- Investor introductions and funding facilitation

- Market strategy and validation support

- Growth planning and scaling advisory

- Ecosystem connection and networking facilitation

Startup Registration Cost Structure

Government Fees and Charges

Registration Costs:

| Service Component | Cost | Timeline | Validity |

| DPIIT Registration | Free | 15-45 days | 10 years |

| Business Entity Registration | ₹10,000 – ₹25,000 | 15-30 days | Perpetual |

| Professional Services | ₹15,000 – ₹50,000 | Complete process | Support included |

| Total Investment | ₹25,000 – ₹75,000 | 30-60 days | Complete setup |

Additional Investment Considerations

Operational Setup:

- Office setup and infrastructure: ₹50,000 – ₹2,00,000

- Technology development and tools: ₹1,00,000 – ₹5,00,000

- Marketing and branding initiatives: ₹50,000 – ₹2,00,000

- Legal and compliance support: ₹25,000 – ₹75,000

- Working capital requirements: ₹2,00,000 – ₹10,00,000

Professional Services:

- Business plan development: ₹25,000 – ₹75,000

- Financial modeling and projections: ₹15,000 – ₹40,000

- Legal documentation and agreements: ₹20,000 – ₹60,000

- IP registration and protection: ₹25,000 – ₹1,00,000

- Compliance management services: ₹10,000 – ₹30,000 monthly

Future Opportunities and Trends in Startup Registration

Government Policy Developments

Emerging Support:

- Startup India 2.0 and enhanced benefits

- Global startup program and international expansion

- Women entrepreneur specific schemes and benefits

- Rural startup promotion and support programs

- Green startup initiatives and sustainability focus

- Deep tech innovation and advanced technology support

Policy Enhancements:

- Simplified regulations and reduced compliance burden

- Fast-track approvals and single-window clearances

- Enhanced funding support and government investment

- International collaboration and market access

- Skill development and talent programs

- Innovation hubs and infrastructure development

Technology Integration

Digital Transformation:

- Online platforms for complete registration process

- AI-powered application processing and evaluation

- Blockchain-based verification and documentation

- Digital identity and startup credentials

- Automated compliance monitoring and reporting

- Real-time tracking and status updates

Startup Registration Services in Jaipur

At Tax2Filing, we provide comprehensive startup registration services for innovative ventures:

Our Startup Registration Package Includes:

✅ Complete eligibility assessment and consultation

✅ Business plan development and refinement

✅ Entity incorporation and legal setup

✅ DPIIT registration application and submission

✅ Documentation preparation and quality assurance

✅ Follow-up support and status tracking

✅ Benefit optimization and claim assistance

✅ Compliance guidance and ongoing support

✅ Investor introduction and funding facilitation

✅ Ecosystem connection and networking support

Why Choose Tax2Filing for Startup Registration?

- Startup expertise with 150+ successful registrations completed

- Comprehensive support from ideation to registration and beyond

- Government relations and regulatory expertise for smooth processing

- Investor network and funding facilitation capabilities

- Technology-enabled tracking and status management

- Cost-effective solutions with transparent pricing structure

- Local presence in Jaipur with startup ecosystem connections

- Ongoing support for compliance and growth advisory

Our Startup Registration Timeline:

- Week 1-2: Consultation, eligibility assessment, and planning

- Week 3-4: Entity incorporation and business setup

- Week 5-6: Documentation preparation and application filing

- Week 7-10: DPIIT processing and follow-up

- Week 11-12: Approval, certificate delivery, and activation

Frequently Asked Questions About Startup Registration

Q1: What is the difference between startup registration and regular business registration?

Startup registration provides specific government recognition under Startup India with access to tax benefits, funding opportunities, and regulatory advantages, while regular business registration only provides basic legal entity status.

Q2: How long does startup registration take to complete?

Startup registration typically takes 6-12 weeks from application submission, including entity incorporation, DPIIT application processing, evaluation, and certificate issuance.

Q3: Can any business apply for startup registration?

Startup registration requires meeting specific criteria including innovation focus, incorporation within 10 years, turnover below ₹100 crore, and scalability potential for employment or wealth creation.

Q4: What are the main benefits of startup registration?

Startup registration provides tax exemptions, patent cost reduction, regulatory simplification, funding access, government scheme participation, and networking opportunities within the startup ecosystem.

Q5: Is startup registration free of cost?

Startup registration with DPIIT is free, but entity incorporation, professional services, and documentation may involve costs ranging from ₹25,000 to ₹75,000 depending on requirements.

Q6: Can foreign nationals get startup registration in India?

Foreign nationals can participate in startup registration through Indian entities with appropriate ownership structures and compliance with FDI regulations and foreign investment guidelines.

Q7: What happens after startup registration approval?

After startup registration, startups can access tax benefits, apply for government schemes, participate in funding programs, and must maintain annual compliance reporting and status updates.

Recent Updates and Future Developments

Policy Changes and Enhancements

2025 Updates:

- Turnover limit increase from ₹25 crore to ₹100 crore

- Incorporation period extension from 7 to 10 years

- Simplified application process and reduced documentation

- Fast-track processing for technology startups

- Enhanced benefits for women and rural entrepreneurs

Upcoming Initiatives:

- Global startup visa program for international expansion

- Deep tech specific schemes and advanced technology support

- Climate tech focus and sustainability incentives

- Rural innovation hubs and tier-2/3 city programs

- International collaboration and cross-border opportunities

Conclusion: Launch Your Startup with Official Registration

Startup registration is the gateway to accessing government support, funding opportunities, and ecosystem benefits that accelerate entrepreneurial success. From tax exemptions to investor connections, startup registration provides the foundation for building a scalable, sustainable venture with comprehensive support.

Ready to launch your innovative venture with startup registration? Tax2Filing in Jaipur provides end-to-end startup registration services, from ideation support to DPIIT certification and beyond. Our experienced team guides entrepreneurs through the complete process, ensuring maximum benefit access and regulatory compliance.

Begin your startup registration journey today:

📞 Expert Consultation: +91-8505005237

🏢 Visit Our Office: Tax2Filing, C-Scheme, Jaipur

📧 Email: info@tax2filing.com

⚡ Fast-Track Service: Complete startup registration within 12 weeks

Transform your innovative idea into a recognized startup with professional startup registration services from Tax2Filing – Your partner for entrepreneurial success!