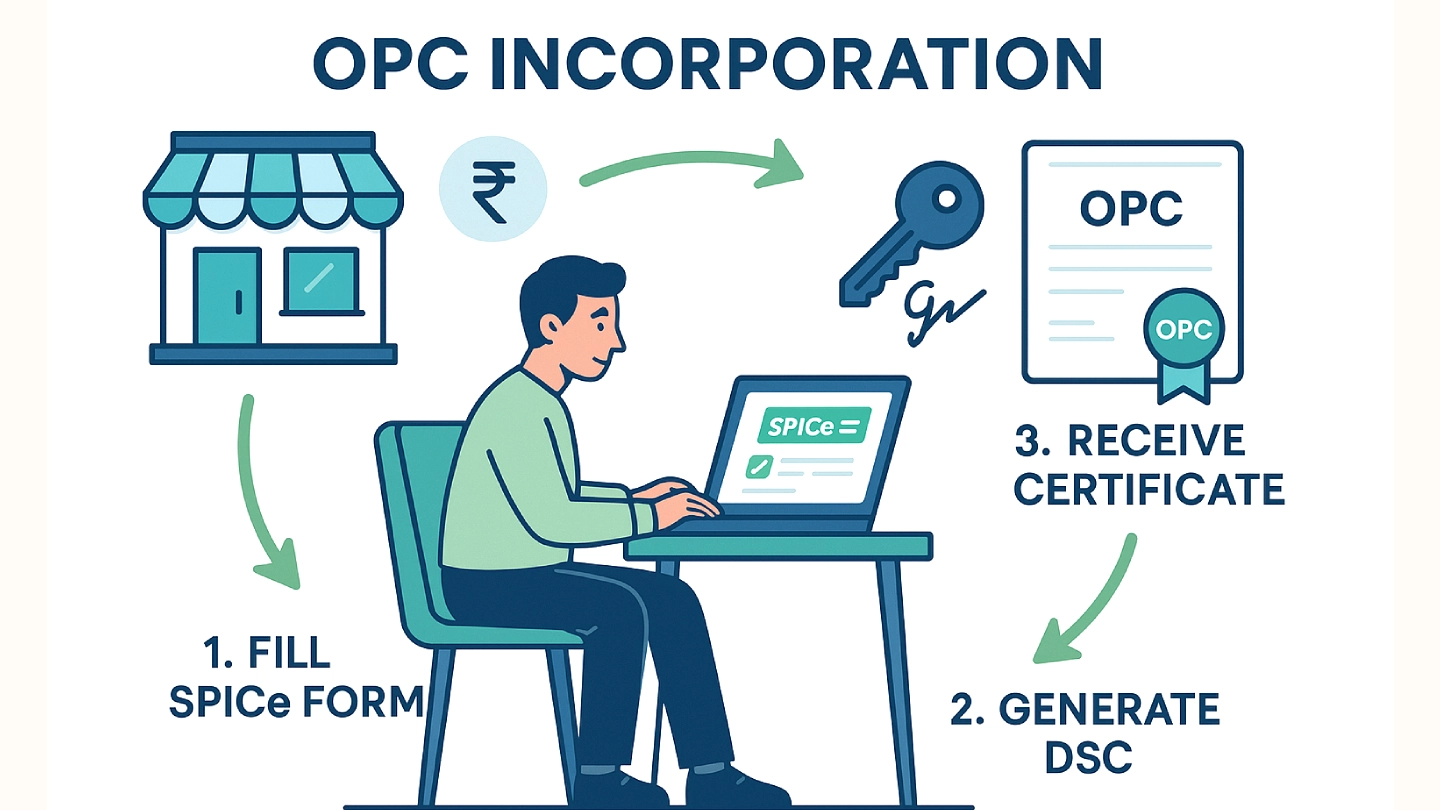

Incorporation of One Person Company (OPC) Services

Professional OPC incorporation services by expert CAs to establish your single-member company legally. Our team handles complete One Person Company incorporation process including name reservation, documentation preparation, MOA/AOA drafting, director appointment, and regulatory filings. We ensure smooth incorporation with minimal compliance requirements and maximum business flexibility for solo entrepreneurs.

Key Benefits:

- Complete OPC incorporation process

- Single-member company setup

- MOA/AOA preparation

- Minimal compliance requirements

- Maximum business flexibility

Start your solo business venture with our expert OPC incorporation services.